This is a foreign policy event by Canadians. My name is Jenna Herrera, and I am a member of the executive committee of the Canadian International Council Victoria Branch here on Vancouver Island. Before we do get underway, it's important to recognize that CIC Victoria members live, work, and learn on the traditional territories of the Lokwangan speaking first peoples, the Songs and Esquivel Nations, and gratefully acknowledge the Co-Salish Nations on whose territory Tories meet today. For those not familiar with the Canadian International Council, we are an independent, non-partisan membership-driven think tank with the express mandate to engage Canadians on international affairs and promote a deeper understanding of Canada's role in a changing international landscape. What makes us different from many think tanks is that we have branches in 17 Canadian cities with some 1400 members who are deeply involved with and interested in Canada's role in our world. You can find out more about us by Googling the Canadian International Council, where you can also find our CIC Victoria webpage. Today our moderator will be Marilyn Denton, and I will introduce her shortly. Then Marilyn will take over and introduce our speaker and discuss it after the talk. There will be an audience question and for this, please use the Q&A area. We'll do our best to get to all the questions. We're also recording this event. Our moderate moderator today is Marilyn Denton, a member of the executive committee of CIC Victoria Maryland retired in Victoria after 27 years working for the federal government. Most of her career was spent in Ottawa, but she has lived abroad in Pakistan and Jamaica. She has traveled extensively for her work in the Asia-Pacific region, and she also worked in the private sector on various contracts. She was one...

PDF editing your way

Complete or edit your Canada FIN 146 2016 Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export Canada FIN 146 2016 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your Canada FIN 146 2016 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Canada FIN 146 2016 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

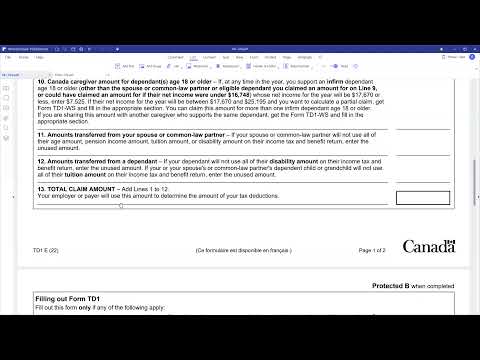

How to prepare Canada FIN 146 2025 Form

About Canada FIN 146 2025 Form

The Canada FIN 146 2025 Form, also known as the Information Return of Tax Paid or Payable Non-Resident Corporation, is a tax form used by non-resident corporations in Canada to report their tax liabilities and remittances to the Canada Revenue Agency (CRA). This form is specifically designed for non-resident corporations that have earned income or conducted business activities in Canada, and thus are subject to Canadian tax obligations. It is a mandatory requirement for these corporations to file this form, irrespective of whether they have any tax payable or not. The purpose of the FIN 146 form is to provide information to the CRA about the non-resident corporation's Canadian-source income, expenses, and any taxes paid or deemed paid in Canada. It allows the CRA to assess and verify the non-resident corporation's tax compliance and ensure they have met their tax obligations in Canada. The information required in the FIN 146 form includes details about the corporation such as name, address, fiscal period, and status as a non-resident. It also requires the corporation to report its income from Canadian sources, deductions, credits, and taxes paid or payable. Overall, any non-resident corporation that has conducted business activities or earned income in Canada must file the Canada FIN 146 2025 Form annually to comply with Canadian tax regulations.

Online solutions assist you to organize your own report supervision and improve the productiveness of your respective workflows. Keep to the speedy manual to carry out Canada FIN 146 2025 Form, stay away from errors as well as furnish the idea promptly:

How to accomplish any Canada FIN 146 2025 Form on the internet:

- On the website using the template, simply click Start Now and also cross for the manager.

- Use the actual clues for you to fill out the appropriate fields.

- Include your own personal details and contact files.

- Make sure that one enters right data along with figures throughout appropriate job areas.

- Very carefully look at the content material from the PDF and also grammar and also transliteration.

- Navigate to Guidance part when you have inquiries or perhaps tackle our Support staff.

- Put an electronic digital trademark on your own Canada FIN 146 2025 Form with the aid of Sign Instrument.

- Once the proper execution is completed, media Accomplished.

- Distribute your set file through e-mail or fax, printing it out or even save the own unit.

PDF manager permits you to help make adjustments in your Canada FIN 146 2025 Form from the web attached gadget, customize it in accordance with the needs you have, indicator that in electronic format along with deliver in different ways.

What people say about us

Preparing forms online saves your time and effort

Video instructions and help with filling out and completing Canada FIN 146 2025 Form